There’s a hole in the system, dear Draghi, dear Draghi,

There’s a hole in the system, dear Draghi: a hole.

Then fill it dear Olli, dear Olli, dear Olli,

Then fill it dear Olli, dear Olli: fix it.

With what shall I fill it, dear Draghi, dear Draghi,

With what shall I fill it, dear Draghi: with what?

With taxes dear Olli, dear Olli, dear Olli,

With taxes dear Olli, dear Olli: try tax!

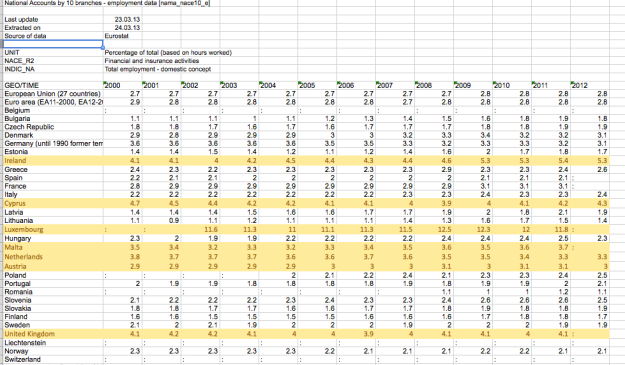

But the tax take is falling, dear Draghi, dear Draghi,

But the tax take is falling, dear Draghi: it falls!

Increase them dear Olli, dear Olli, dear Olli,

Increase them dear Olli, dear Olli: whack’em on!

But tax take falls more now, dear Draghi, dear Draghi,

But the tax falls more now, dear Draghi: it fell!

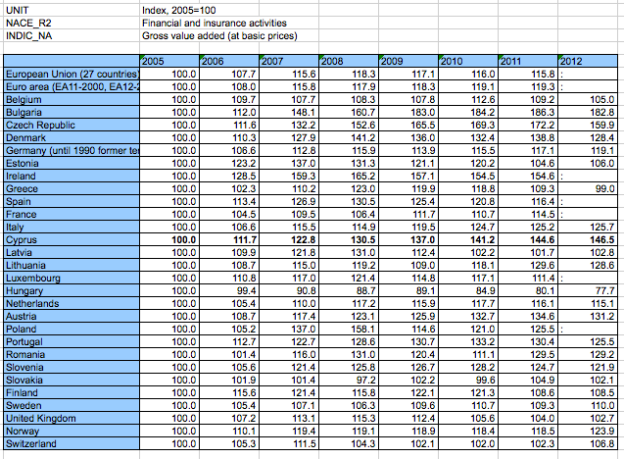

Squeeze the sovereigns, dear Olli, dear Olli, dear Olli,

Squeeze the sovereigns dear Olli, dear Olli: squeeze them!

But the sovereigns are bursting, they’re bursting, they’re bursting,

But the sovereigns are bursting, they’re bursting: some burst!

Try the savers, dear Olli, dear Olli, dear Olli,

Try the savers dear Olli, dear Olli: try them!

The hole just got bigger, got bigger, got bigger,

The hole just got bigger, got bigger: it grew!

Then the bondies, dear Olli, dear Olli, dear Olli,

If you must it’s the bondies, it’s the bondies: burn them!

Now the system is creaking, is creaking, is creaking,

Now the whole system is dear, dear Draghi: it creaks!

[female voice]

Inflate it dear Draghi, dear Draghi, dear Draghi,

Inflate the system it dear Draghi, dear Draghi: inflate!

But I don’t have a mandate dear Christine, dear Christine,

But I don’t have a mandate dear Christine: don’t ask!

Well then print it, dear Draghi, dear Draghi, dear Draghi,

Well then print it dear Draghi, dear Draghi: please print.

But we don’t have a printer, dear Christine, dear Christine,

We don’t have a printer, dear Christine: there’s no ink!

Well who make money, dear Draghi, dear Draghi?

Well who can make money, dear Draghi: who can?!

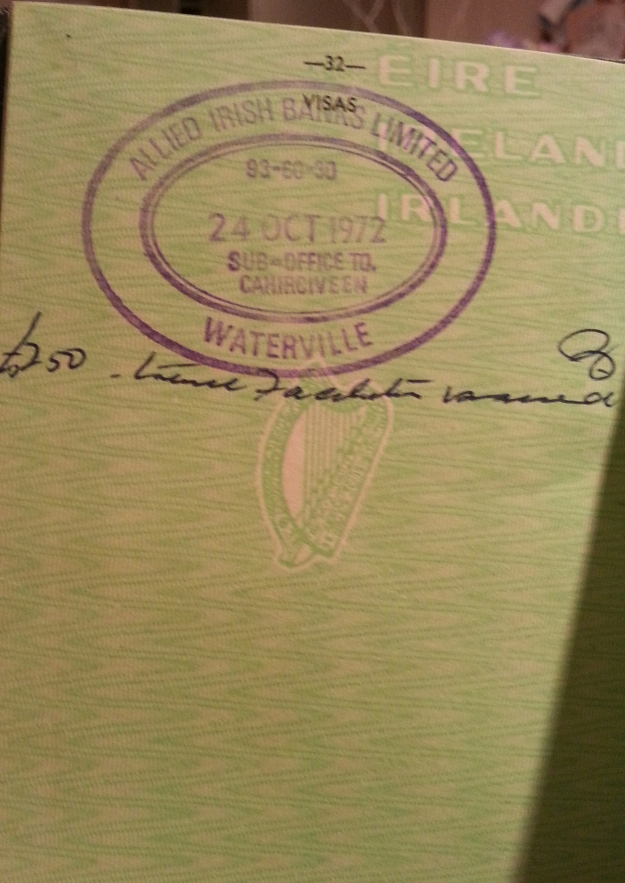

Well the banks are supposed to, dear Christine, dear Christine,

Well the banks are that system, the banks: that’s who!

[All together now]

But there’s a hole in the system, dear Draghi, dear Draghi,

There’s a hole in the system, dear Draghi – a hole!