So the general elauction is in full swing. And the theme of GE2016 is “Irish taxpayers are uniquely, punitively, outrageously taxed, and thats causing all our trouble:. Pretty much every party, bar the courageous (in a Sir Humphrey Appleby way) Social Democrats are pledging to cut, slash, reduce….

Meanwhile, away from the fevered fantasies of Irish political parties, in the real world, this is where we are. Data from OECD Taxing Wages 2015, 2014 data : here

First, the total : the tax wedge, defined as the difference between total costs to the employer (so including PRSI and other social security) vs what the employee gets (so including USC and PRSI). Oh, look….

Then tax on the average wage (a shade under €700 per week for 2014 from CSO data) by family type. Cash transfers here are the standard benefit packages such as childrens allowance or its equivalent.

Finally at different percentages of the average wage. Ireland is in red.

Feeling overtaxed is fine. Claiming that we are, at least in the comparative sense, is not. Its not just a misreading, its a misrepresentation. We get the politicians we elect. If we elect people who look us in the eye and lie a hole in a pot, so be it.

The January Barometer in stocks is an old saw “as January goes, so goes the year”. So a down January, as we have just seen, should spell trouble ahead for the stock market. So, is it true?

The January Barometer in stocks is an old saw “as January goes, so goes the year”. So a down January, as we have just seen, should spell trouble ahead for the stock market. So, is it true?

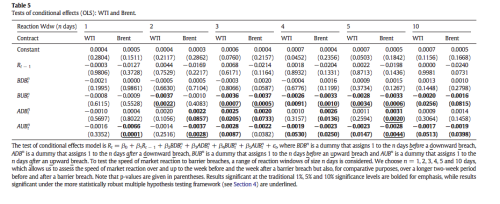

With the recent collapse in oil, this may be of interest. A research paper (co-authored with two other colleagues) and published in Energy Economics . Full paper available

With the recent collapse in oil, this may be of interest. A research paper (co-authored with two other colleagues) and published in Energy Economics . Full paper available

So the Renua flat tax proposal continues to keep them in the headlines, as I guess was the idea. But do we have any actual evidence as to the effects of flat taxes? What do we know, as opposed to what can we assert?

So the Renua flat tax proposal continues to keep them in the headlines, as I guess was the idea. But do we have any actual evidence as to the effects of flat taxes? What do we know, as opposed to what can we assert?