So : we know now that Ireland was indeed threatened. But a bigger issue seems to lurk , but this may be just my ignorance Continue reading

Tag Archives: Anglo Irish Bank

Will QE do the trick for Europe and Ireland?

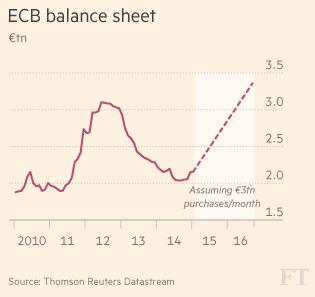

So the ECB has, years late and trillions short, decided to act rather than to react. Having passively allowed its balance sheet, shrink By €1 trillion over the last two years it has now decided to inflated its balance sheet by €1 trillion over the next two years. One of the things that central banks are supposed to do is to ensure stability. Looking back from the end of 2016 the gyrations of the ECB balance sheet will hardly inspire. Nonetheless the proposal to engage in quantitative easing, of a sort, is welcome. But its more a constipated squeezing than real quantitative easing. Continue reading

So the ECB has, years late and trillions short, decided to act rather than to react. Having passively allowed its balance sheet, shrink By €1 trillion over the last two years it has now decided to inflated its balance sheet by €1 trillion over the next two years. One of the things that central banks are supposed to do is to ensure stability. Looking back from the end of 2016 the gyrations of the ECB balance sheet will hardly inspire. Nonetheless the proposal to engage in quantitative easing, of a sort, is welcome. But its more a constipated squeezing than real quantitative easing. Continue reading

Hyperbolics, Banks and Elections

There is an interesting opinion piece in the Irish Times today, by Michael Noonan, the finance minister. It is being spun as “were going to get our money back from the banks”. This is not the first or second time of course we have heard that we are going to get the money back, and it will not be the last. We need to take enormous caution when interpreting what politicians say, especially when they talk about banks, and especially when they talk about banks in the run-up to an election. Continue reading

Politicians – Misled or Misleading on Anglo.

We don’t have to pay a cent to the Anglo junior debtholders but we probably will. Below I walk through why the Government are either misled or misleading and opine on how we can avoid payment. We have a legal template, which could be tabled. FF should continue to drink its tall glass of STFU on Anglo, so it is down to the opposition. Sinn Fein are busy posturing on meaningless motions on the Taoiseach, the anti-austerity-unless-its-a-party-leaders-allowance-before-logic-party is doing whatever it does, so really its down to people like Shane Ross, Stephen Donnelly, Tom Pringle and so on, the (apparently ) concerned left and right, to table this. Continue reading

We don’t have to pay a cent to the Anglo junior debtholders but we probably will. Below I walk through why the Government are either misled or misleading and opine on how we can avoid payment. We have a legal template, which could be tabled. FF should continue to drink its tall glass of STFU on Anglo, so it is down to the opposition. Sinn Fein are busy posturing on meaningless motions on the Taoiseach, the anti-austerity-unless-its-a-party-leaders-allowance-before-logic-party is doing whatever it does, so really its down to people like Shane Ross, Stephen Donnelly, Tom Pringle and so on, the (apparently ) concerned left and right, to table this. Continue reading

Ghosts of Anglo’s Past

If Irish water is the Omnishambles of 2014 then Anglo Irish bank is likely to be the omnishambles of the first several decades of this millennium. Like some banking Chernobyl poorly encased in an ill designed hastily erected carapace it continues to leak its toxicity poisoning all around it. Anglo let us not forget was brought low by its participation in, fuelling of, and entwinement with the housing market. Continue reading

A Fractal Omnishambles and the ECB

It’s little wonder that the Irish government has not pressed harder against the European central banks approach to the Irish banking crisis. The reality seems to be that both are very similar, in at least one key characteristic. Both seem unable to accept that a mistake, once made, should be acknowledged as such, and that this does not have to represent a humiliating climbdown but rather evidence of a learning organisation. Continue reading

What Ireland’s crash tells us about bankers views on Scottish Independence

The next week is going to be fascinating. I have no idea how Scotland will vote, for or against independence. I have no idea how I would vote were I there. Economically, there is probably a somewhat stronger argument for NO than YES, if you believe the politicians promises. But national self determination is not about economics alone. Ireland has seen a massive crash, from its overblown banking system. How bankers and other vested interests responded to that is very instructive for the scottish debate

How to mitigate the next recession..

The madness, it seems, has returned. Perhaps like those insects that lay eggs that can survive drought and then swarm back, it never left, just lay dormant. Santayana’s maxim of the inevitability of repetition if one comes from a position of ignorance could be the warcry of Irish policy “ we repeat our mistakes, and we’re proud of it. Vote us” And we do. Continue reading

Does An Irish Solution loom for European Banks (one way or the other) ?

This is a version of my column in the Irish Examiner of 25 Jan 2014 .Europe’s banks are broken. Very broken. We have always suspected that, but recent evidence in indications suggest that nearly six after the crisis first began to manifest itself seriously they are still grossly impaired. The drive towards meaningful banking union has stalled again amidst squabbling about whether or not there should be and if so how much of a common pot for resolution. German banking giant Deutsche unveiled a billion euro loss just this week, underscoring how fragile both the banking system and the economy remain, even at the core. Without a working banking system the economy cannot prosper.

This is a version of my column in the Irish Examiner of 25 Jan 2014 .Europe’s banks are broken. Very broken. We have always suspected that, but recent evidence in indications suggest that nearly six after the crisis first began to manifest itself seriously they are still grossly impaired. The drive towards meaningful banking union has stalled again amidst squabbling about whether or not there should be and if so how much of a common pot for resolution. German banking giant Deutsche unveiled a billion euro loss just this week, underscoring how fragile both the banking system and the economy remain, even at the core. Without a working banking system the economy cannot prosper.

Recall what it is that banks do – despite the mystique and the bluster, its actually pretty simple. Some people have money and others need it. Banks act as a middleman to facilitate those that want it to get it from those that have it, in return for them taking a cut of the interest charged. This can be across space (savings flow from region to region) and/or time (mortgages and longer term loans) . Lending money out is risky. That is why banks charge an interest rate on loans that is greater than that which they pay on deposits – apart from needing to make a profit and cover costs, they need to put some money aside for the inevitable defaults and bad loans. These retained profits, plus some other ‘safe’ assets, are the banks reserves, or its capital

There is a persistent fallacy that banks lend out reserves. They don’t. People such as Frances Coppola have been banging on about this fallacy for some time now (see here and here) Its more complicated than that and revolves around the fact that banks can create credit (money) by issuing loans. However, banks do need, under prudential regulation, to hold a certain amount of capital, a proportion of the assets they have (loans made). If banks have more capital they are in a position to expand. The problem for European banks is that they are stymied by the fact that they have written down bad loans to an extent sufficient to impair their capital base but by no means enough to clean their balance sheet of the these bad loans. Caught in a double bind, they are unable to efficiently do their job as intermediaries and as credit creators.

As part of the ongoing efforts to get to the root of the problem the ECB have initiated an asset quality review. This is in effect yet another stress test. Previous not-terribly-stressful tests have been greeted with derision as they in effect claimed that all was well when it was manifestly not. Thus this stress test, to be credible, needs to fail some banks – any banks. It is reminiscent of Admiral Byng, who was shot not for failing at his task of taking Minorca, more or less impregnable and a rock on which others had foundered, but ‘pour encourage les autres’. European banks all stand in danger of being the financial Admiral Byng of 2014. One or more large banks needs to fail to show the virility of the tests.

Recent research has looked at what holes might be lurking in the capital. As has been the case throughout this crisis while high level public data cannot give a precise amount it has been remarkable how using such data the gross magnitude and nature of the money sink de jure has been accurately estimated. Looking at the 109 largest banks with €22 tr in assets a hole of between 5b and 66b is found even assuming no further deterioration of any assets – an unstressed situation. The biggest holes are in the core – French and German banks and the smallest in the periphery. Ireland, if things don’t get any worse, does not need any more capital in its banks.

But what if things do go south? They stress the banks rerunning a severe financial crisis, and further suggest that any residual bad loans are written off. Writing off bad loans of capital weak banks is the only way to kill zombie banks who crowd out and hinder the banking system. In this stress situation the banks are woeful. Assuming reasonable levels of reserves to be held, European banks may need between 500b and 750b. Again the worst holes are in the core banks especially French German and Belgian banks. Top of the list are the giant french banks – Credit Agricole, BNP and SocGen, and Deutsche Bank. Bank of Ireland and AIB are not immune, possibly requiring 6-13b euro more. But sure were good for that, havent we turned the corner and exited the bailout to a land of green shoots…

So what to do? Senior bondholders are sacrosanct and while depositors of unimportant nations such as Cyrus (whose banks are still bunched beyond reasonable hope of redemption) might be bailed-in that wont happen to real depositors, those of the core. So banks will limp along. But there is a potential solution – promissory notes. The notes were created to shore up the capital base of Anglo Irish Bank, and allowed it to access liquidity from the Central Bank of Ireland. Which it did. Ok, Anglo was a hopeless case but the principle is good. The problem with the notes was not per se their existence – it was that they were required to be extinguished over a fairly swift timetable, placing unbearable strain on an already strained exchequer and that it was done to put a figleaf on the notion that Anglo was a going concern.

Were these or national equivalents to be created by the national authorities of the core, we could well imagine much longer periods for extinguishing being placed in play. If the Anglo ProNotes had been repaid over 300 years instead of 30 they would not have been an issue, except morally. While the numbers seem large, in the context of the (shrinking ) ECB balance sheet of 2.2b even the largest amount required is not unbearable. Part of the ECB objection to the notes was that the liquidity created was done so “outside its control”. A system of central banks cannot have individuals pursuing their own monetary policy in an uncoordinated and national focused way – that is what brought down the Rouble zone. But as a once off final fix for the banks? Its worth a shot. In all probability the 750b would not be required in full. While the 40% fall over 6 months in equity values is high, this does not happen very often – but it does happen about 1 time in 25. Doing this would ‘cure’ the banks, in so far as it would allow, in fact would have to be accompanied by, a full write-down of impaired loans and thus position them for regrowth. It would allow a clean start to be made. Clean the mess up once and for all, and restart.

Alas, the inflation hawks and their fears dominate the ECB, fears never more imaginary than now with deflation staring the Eurozone in the face, will not allow this. The consequence is that we flirt with a further crisis not merely knocking out the periphery but the core. As we have throughout the crisis we face a choice of unpalatable alternatives. European banks will follow the irish lead – either via partial or full zombification with the odd twitch of life now and again while hoping that the economy does nothing remotely scary all the time barely functioning and taking a decade or more to get back to any health, or by the solution which worked, in that it allowed a bank to be cleansed and to br resolved.

100 things Ireland could have got for the price of one Anglo Irish Bank…

With the #anglotapes this week it seemed to me a good time to recall those heady days of August 2010 when we had spent only 25b on Anglo. At that time Ronan Lyons and I penned this little piece in the Sunday Business Post…

This week, it was announced that the EU had approved a further injection of our taxpayer money into additional capital for Anglo-Irish Bank . This brings the total as of now to almost €25bn. This is money going into a bank that is essentially in wind-down over the coming decade, money that the Irish citizens and taxpayers will not see again, as it is shoring up the balance sheet of a bank that had too much imaginary wealth. And that is not the end of the money, many fear.

So just how much is €25bn that we are having to borrow for Anglo? In one way, it’s small change, compared to what will possibly be €200bn in borrowings by the State to fund the non-banking deficit between the onset of the crisis and 2020. But to any rational mind €25bn is still a mind-bogglingly large amount of money. The State has limited borrowing capacity, limited by a combination of what the taxpayer can repay. In putting €25bn into Anglo, the government, on our behalf, has spent money that can not be used for other projects. Here is a list, then, of 100 things – grouped into various categories – that the government could have spent €25bn but chose not to.

Ireland could make a major contribution to Fight Global Poverty

€25bn would go a long way in the fight against global poverty. Here are a few suggestions:

100. Buy enough malaria nets to protect the entire malaria-affected population of the world (half a billion people) for 80 years (based on NothingButNets figures of $10 a net)

99. Completely fund the World Food Programme for five years

98. Repair twice over the damage done to Haiti in the recent earthquake

97. Fund enough clean water and infrastructure projects to meet the Milliennium Development Goals in those areas

96. Buy up and extinguish the national debt of Bangladesh

95. Fund the UNESCO “Information for All” Project for 1200 years

94. Provide food aid to Niger for 1000 years

93. Asphalt every trunk and regional road (110,000km) of substandard road in sub-Saharan Africa

Ireland could become a World Science & Technology Hub

Major scientific and technological projects cost a lot of money. But rarely €25bn. Here are a few ways Ireland could have used the €25bn to become a global hub for major breakthroughs in science and technology.

Major scientific and technological projects cost a lot of money. But rarely €25bn. Here are a few ways Ireland could have used the €25bn to become a global hub for major breakthroughs in science and technology.

92. Start our own space programme, with twenty €1.2bn space shuttles

91. Foot the bill for a century of global research into nuclear fusion (the current 30-year global ITER project is expected to cost €5-10bn)

90. Research & develop 5000 new drugs….one of em’s bound to be useful

89. Construct 6 Large Hadron Colliders – one for each Green Party TD

88. Build 5 James Webb Space Telescope (the successor to Hubble), and revolutionise astronomy

87. Build two magnetoplasma space vehicles which in theory could get to mars in 40 days

86. Build a space elevator

85. Build two ITER nuclear fusion reactors and provide the world with cheap, abundant energy..

We could decide to give ourselves a break

What about using the €25bn to give ourselves a break? Here are a number of things that €25bn could pay for, while we take a break.

What about using the €25bn to give ourselves a break? Here are a number of things that €25bn could pay for, while we take a break.

84. Pay the interest on everyone’s mortgage for 4 years (€147bn of mortgages at 4% is €5.88bn a year)

83. Abolish income tax for two years (based on 2009 gov income tax receipts of €11.8bn)

82. Offer everyone on the live register €100,000 to emigrate (we could afford a 50% take-up by the 466,000 on the dole)

81. Abolish VAT for two and a half years (based on 2009 receipts of €10.8bn)

80. Remove exise duty from fuel, tobacco and alcohol until 2015 (based on exise receipts of €4.7bn a year)

79. Pay the grocery bills of everybody in the country for 2.5 years

78. Scrap all fares on all forms of public transport, intercity and commuter trains and buses for 33 years

We could just treat ourselves

We could just treat ourselves with the €25bn windfall. Here are some suggestions as to how.

We could just treat ourselves with the €25bn windfall. Here are some suggestions as to how.

77. Run the world’s best ever lottery – every Irish citizens is entered into a draw where 25,000 people become millionaires!

76. Give every OAP a pension of 55,000 for a year….

75. Fly the adult population of Ireland to Las Vegas, give everyone 10k to gamble with

74. Give every person in the country €5,555.56

73. Buy half a million ecofriendly Nissan Leaf cars and have enough for a 5GW nuclear power station with the cash left over

72. Provide a new laptop every year to every second level student for 147 years

71. Buy a 32GB iPhone, a 64GB iPad, a 13″ 2.13GHz MacBook Air and a 27-inch iMac for every man, woman and child living in Ireland

We could treat the world

Treating ourselves is probably a bit selfish. Here are some ways to make the rest of the world like us more!

Treating ourselves is probably a bit selfish. Here are some ways to make the rest of the world like us more!

70. Buy 6.7b copies (one for everybody in the world) of Joyce’s “portrait of the artist as a young man”

69. Buy a pint of guinness for everyone in the world to celebrate Arthurs Day (and it would count as exports)

68. Buy every child in the world a 99 ice-cream cone every day for a week

67. Send every adult in the world on an MSc in Social Media in NCI

66. Send 225,000 people to do the Harvard MBA

We could truly become the world’s biggest sports fan

Sport is big business. But not that big. With €25bn, we could…

Sport is big business. But not that big. With €25bn, we could…

65. Buy the world’s 20 most valuable soccer clubs, worth €9.6bn, wipe their debt (€2.3bn) and move them to Ireland, building each a 75,000-seater stadium (€600m each, based off cost of Aviva stadium)

64. Host two Olympics games, based on the London 2012 cost of €11.2bn

63. Buy Tonga and Fiji, which would have obvious rugby advantages

62. Construct 25 Bertie-bowls (one for each county except Dublin!)

61. Buy 83,300 McLaren supercars

60. Buy the entire stock of tickets and merchandise for all premier league clubs for the next 12 years

We could decide to really become a major player on world markets

Banking and finance got us into this mess. Surely they can get us out?

Banking and finance got us into this mess. Surely they can get us out?

59. Buy €600bn in Credit Default Swaps on Ireland (could pay off nicely in the next few years!)

58. Buy two of Asia’s largest banks – Bank Central Asia and Malayan Banking

57. Recapitalise ALL the banks in europe that failed the stress tests

56. Purchase Monsanto, as a present for the green party, or (buy Nokia as a present for Ivor Callely)

55. Give each one of the 10,000 most senior bankers a round of golf on old head kinsale, the most expensive course in europe, every day for 20 years, and hope that they come up with some ideas!

54. Subsidise the US postal service for ten years

53. Allow the Italian Government to not put in place its 3 year austerity plan

52. Pay the salaries of TCD and UCD academics for 100 years.

We could just do it because we can…

While the Government says it’s not a waste of €25bn, many people believe it is. Here are ten ways to really spend €25bn.

While the Government says it’s not a waste of €25bn, many people believe it is. Here are ten ways to really spend €25bn.

51. Buy Steve Jobs (€25bn is actuarial value on his life) and get him to work for Ireland Inc.

50. Buy gold plating 1.75mm think for O’Connell Street

49. 25,00 carats of red diamond, enough to encrust a mercedes….

48. Build a shed 10k long by 4k wide and put it around Tullamore…

47. Buy every one of the 5.8m cattle in the country, and to keep their little feet cosy two pairs of jimmy choos each

46. Detach the People’s Republic of Cork from the Republic of Ireland, by constructing a 10-metre wide moat – the per-kilometre cost of the new Gothard Tunnel in Switzerland suggests this may cost €30bn but I’m sure we could haggle them down in a recession.

45. Cover the entire county of Dublin a foot deep in corn

44. Hire Bertie to speak for 95 years

43. Purchase carbon credits to allow us to burn 3000 sqmiles of hardwood forest

42. Build 20 copies of the Burj Khalifa Dubai, the worlds tallest building

We could just splash the cash

When people win the lottery, there’s naturally a tendency to splash the cash. Winning a €25bn lottery would certainly allow us to splash the cash. Here are some ideas.

When people win the lottery, there’s naturally a tendency to splash the cash. Winning a €25bn lottery would certainly allow us to splash the cash. Here are some ideas.

41. Buy 1,000 luxury yachts to kickstart the Upper Shannon Rural Renewal Scheme (78-footers, 2nd-tier Russian oligarch standard)

40. Buy over one third of Denmark, 10% of France or three Luxembourgs, based on 2008 land costs

39. Send 833 people into space (or perhaps just 1666 one way trips…)

38. Stay in the most expensive hotel room in the world for 3400 years (it’s the Atlantis resort, Bahamas in case you were wondering)

37. Build 50 ginormous cruise liners akin to Carnival Splendour or Queen Mary 2

36. Make 100 Avatar-type films, which lets remember made back its money x4 at the box office!

35. Buy every TD a boeing dreamliner, ideal for those trips to glenties

34. Purchase 35 of the world’s most expensive mobile phone (goldstriker iPhone 3GS supreme) for every member of the oireachtas!

33. Build four Libraries of Alexandia in each county

32. Endow one university to the level of Harvard

31. Tile Dun Laoghaire-Rathdown totally in nice porcelain

30. Buy five Nimitz Class Nuclear supercarriers to scare the bejaysus out of the Spanish trawlers

29. Or buy 17 Virginia Class nuclear attack submarines, if we wanted to sneak up on the Spanish Trawlers instead

28. Supply the water needs of Galway City, for a year…with Perrier water

27. Purchase four Birkin Hermes bags for every adult female in the country, one for each season’s wardrobe

26. Buy and install 100 sq yards of parquet flooring for every single dwelling in the country.

25. Fill the Jack Lynch Tunnel with Midelton Single Cask whiskey

24. Purchase 225,000 kg of the most expensive truffles in the world

23. Buy every house and apartment listed on DAFT.ie and still have 12bleft to refurbish them

We could transport ourselves out of this mess

With €25bn in our back pockets, all those pie-in-the-sky superprojects would no longer be pie in the sky! Here are ten ways Ireland could put itself on the global superproject map.

With €25bn in our back pockets, all those pie-in-the-sky superprojects would no longer be pie in the sky! Here are ten ways Ireland could put itself on the global superproject map.

22. Construct our own “Channel Tunnel” from Rosslare to Pembroke (based on the cost of the Jack Lynch tunnel)

21. Build 1,000 km of high-speed rail, serving all major coastal cities on the island (based on recent costs in Spain)

20. Build 11,150 miles of dual carriageway

19. Put in place a 400 station metro (if we could build it for the cost of porto’s metro)

18. Put in place a Maglev train from Belfast to Cork via Dublin

17. Build our own Three Gorges Dam, complete with turbines

16. Put in place 12 new Luas lines

15. Build just short of two Hong Kong International Airport (€15 bn each)

14. Build 12 New York-style “Freedom Towers” at €2bn each

13. If we didnt want a tunnel we could five Oresund-style 20km long bridge (Denmark – Sweden, €5b)

We could pay for improved public services

And lastly, ten slightly more practical ways to spend €25bn

And lastly, ten slightly more practical ways to spend €25bn

12. Build 75 brand new 50-teacher schools and run them for 75 years

11. Build 35 new Children’s Hospitals (based on €700m cost of new Children’s Hospital in Dublin)

10. Pay for an extra 5,000 hospital consultants for 62.5 years, based on Finnish wage (or for 29 years based on Irish wages)

9. Pay for cervical cancer vaccines for every girl going into 1st year for the next 8333 years

8. Reduce the pupil teacher ratio in primary schools to 1 in 10 for the next 20 years

7. Given an ultra highspeed fiberoptic broadband connection to every single house (including ghost estates…)

6. Buy 8,500 years of private speech and language counselling and really help autistic and speech problematic children

5. Introduce free pre-schooling for 32 years, based on an average cost of €700 a month for two years of 10 months, for all 110,000 children in the country

4. Make education properly free – the current cost from primary school to degree graduation is €70,000 per child. €25bn would bring nearly 400,000 students through their entire education

3. Give medical cards to everyone, for 25 years based on €500m cost in 2009 to cover 1.5m people

2. We could use the money to renew and replace the drainage and water system of all mains

1. Or we could buy one broken bank…oh, hang on…..

So, a mixture of the bizarre, the stupid, the deeply practical, the useful, all tinged with a sense of lost opportunity. A bit like the governments solution to the banking crisis really! What this list shows us is that choices matter. Its unlikely that any government would have #50, paving o’connell street in gold, as a priority (well, not perhaps unless its leader was from Dublin Central…), But wouldnt it be nice if we had a government with the courage and vision to do #18, a maglev on the east coast, which would catapult ireland into a world leading techological position and cement the all ireland economy? or decide #96 to lift Bangladesh out of poverty? Or …the list goes on, a list of lost opportunities. And when one considers the additional €100b that represents the structural element of the governent debt, well…While Colm McCarthy is correct, that anger is not a policy, its hard to be anything but enraged when one considers the sheer scale of wasted opportunities.

Note: Ronan and Brian would like to thank all the dwellers in Twitterland for suggesting these, and other more unprintable suggestions. Particular thanks to Lorcan Roche-Kelly and CG for good ideas well costed. We are open to more suggestions.

Brian Lucey and Ronan Lyons