The proposal by the German finance minister, and agreed to by others, that Greece take a five year break from the Eurozone is astounding. Its not so astounding that a man who has been musing on this for years has now tabled it. Schauble has as far back as 2012 been wanting this. What is astounding is that he had the gall to table it at the Eurogroup. Given that the Eurogroup is self admittedly a body with no legal basis or structures, I suppose they can do whatever they want. But when it’s a group of finance ministers musing on something ultra vires we should be concerned. And what they are doing, or proposing to do, is exactly that. Continue reading

Tag Archives: germany

Schäuble, a modern Procustes.

The Greek mess is one in which there is plenty of blame for all sides.

Continue reading

When words collide – Why this is not the end of the Greek crisis

So, as most reasonable people hoped and expected, a compromise has emerged. Greece extends the bailout for four months, has a few days to suggest measures that will work to meet the broad targets therein, but the overall constraints on the primary surplus can, seemingly, be relaxed. So, a less austere bailout. Germany wins on forms of words – the Troika (now unnamed but there) remains, the bailout remains, but the words that are used suggest a lower degree of austerity. Peston sees the Greeks getting the best of it as does Frances Coppola, Bloomberg the Germans, Frances Coppola noting that this gives Syriza a chance to show that it and Greece via it can be trusted to behave like a modern half decently managed country. I think she misses the point in making this point. Greece has an appalling record, but the ordolemmingism that Germany has pushed onto everyone as The One True Way to Prosperity also represents a breach of trust, that states can find their own way within bounds of sense.

Nonetheless, I dont see this as the end. Here, in a picture, is why. Its about words. Humpty Dumpty stated ‘When I use a word, it means just what I choose it to mean — neither more nor less.’. Are Greece and Germany reading the same words while being on the same page? I am not sure.

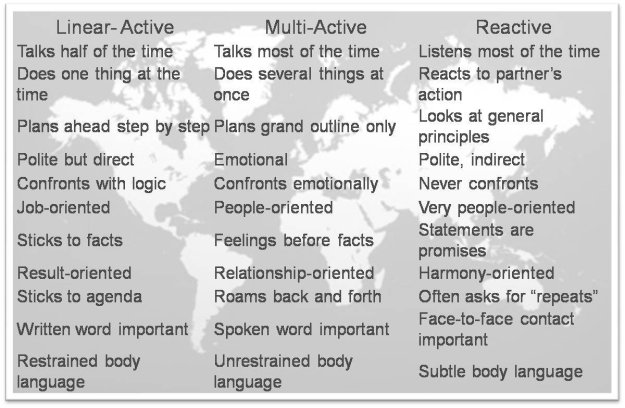

Germand and Greeks use words and impart meaning to language in very very different ways. The diagram is from Richard Lewis, and is a model of national cultures to complement the well known World Value Survey, GLOBE, Schwartz and Hofstede models. Crucially, it concentrates on language. Cultures are arrayed around three main poles. These are as below Germans are Linear-Active. They place great store on the written word, and are planners. Greeks, not so much. The spoken word, in other words, interpretations of what the written word might mean, that is what matters.

Ordolemmingism the new European way.

As I write, on Thursday afternoon, disarray reigns in the Eurozone… again. Astonishingly, it seems that this time it is semantics, whether to call what the Greeks are willing to accept a bridging loan or an extension of the bailout, that has caused the breach. And the fault lies squarely and firmly with the Germans. Again.

Continue reading

Lessons for 2015 from 1919…

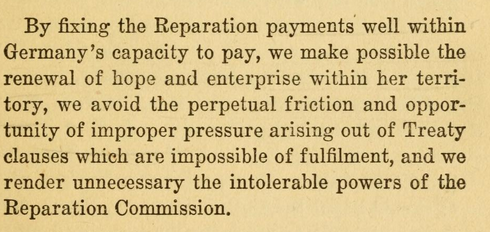

In 1919 Lord Keynes penned a wonderful tome, The Economic Consequences of the Peace. It is a profound work, written by him to express his concern, as an economist, with the punitive and inflexible approach being taken to German debt. It contains nary an equation but is one of the best pieces of economic analysis you will find anywhere. It would be well worth a read by the politicians of Europe.

You cant expect Greece to immiserate itself forever

Germany should realise that a settlement that is generous to Greece will hurt in the shortterm but reap benefits longterm

Debt reduction is the best way forward, then and now…

Handily enough, now as then much of the debt is owed “internally” in a bloc of so called allies…

Just set the payments in such a way as to make it in everybodys interest that Greece trades and prospers

Irving Fisher in 1922 got it spot on…

This government in Greece is soft-medium left. The Nazis await in the wings. Deal with Syriza or reap dragons teeth…

Party like its 1953…

One Made it Out of the Debt Trap Lessons from the London Debt Agreement of 1953 for Current Debt Crises

A very interesting paper on the 1953 London Debt Conference which outlines how it could be a template for the Greek (and other ) debt crises.

The ECB experiment

This is a version of my column in the Irish Examiner of 26 April 2014. Macroeconomics is hard. Its hard because there are actually few coherent theories, such internally coherent theories as we have oftent tend to be at odds with reality, data are of fairly low frequency (monthly usually) and we cant run experiments usually. Those of us who are not practicing macroeconomists thus tend to fall back on fairly simple rules of thumb when assessing policies and outcomes, often by reference to the past. Thus in Europe the ECB has in fact run an experiment against the Federal reserve board. While the Fed has taken the lessons of the 1930s on board and expanded its balance sheet, the ECB has taken the lessons of the 1920 on board and done so reluctantly and is now unwinding them. While the USA engages in quantitative easing, the ECB has engaged in quantitative squeezing. And the results are in; look at the comparative unemployment, performance of the two regions which is really the key metric any sentient or ethical policymakers should concern themselves with. Yes, the USA has an advantage in that they cleaned the banks earlier than did the Eurozone, and thus the monetary transmission system, such as it is in the modern world, was able to work. But that aside it is striking how in recent years the two banks have diverged. It is reasonable to infer that the experiments have had different outcomes.

So you think lack of German demand is not a problem?

Getting to the Hartz of the Irish unemployment problem

Earlier this week I chanced to listen to an interview on the Pat Kenny show. Pat interviewed the Minister for Social Protection, Joan Burton, about reforms and unemployment etc. We have a major problem with unemployment in this country and so any reform is worth looking at if it can assist in solving this issue.

A few things struck me.

First, there was very little discussion of the role of aggregate demand. The minister did note that lots of the unemployed were such consequent to the collapse of the housing bubble. But the ongoing flatlining of the domestic economy was scarcely mentioned.

Second, and flowing from this, much of the debate was on supply side elements. The minister referred time and again to the german (and austrian) experience. When it was noted that these countries were not suffering recession (low aggregate demand) the response was a confused agreement – yes but they have good labour market supply side policies. To my ears this came across as a thinly disguised eulogising of the Hartz reforms.

the Hartz reforms consisted of two elements : a radical shakeup of the state support services, in effect merging and streamlining job agencies, welfare offices, job centers etc and a significant push to force people to take jobs regardless. The first element is surely uncontentious- streamlining and making it easier for people to find any posts that might exist is a good thing. The second however needs debate. It amounted to a significant cut in the payments to the longterm unemployed and a gradual shortening of the period of unemployment benefit.

the premise of the Hartz reforms was that the basic economic environment was, for Germany, benign. There were, it was argued, jobs there for the longterm unemployed BUT the social welfare rates were such as to discourage people taking these.

So what was the effect? A recent IMF paper summarises the finding of research on the issue. While the reforms improved the lot of the employed, it made the situation of the unemployed worse off. It did reduce the longterm unemployment rate by a small amount. Other research supports this overall finding. Further research suggests that the package of Hartz reforms led to an increased substitution of (especially less skilled) full time work by parttime work. Finally, much of the gain appears to come from increased efficiency in matching – in other words the first part of the reforms, improving communication. Finally, Germany has no minimum wage – the resultant wage moderation and other unique features such as hour banking also matter hugely.

So, if we are going to go down the Hartz lines, lets have an open debate on this. By all means lets see a (labour) minister cut the longterm unemployment payment, in the hope that they will find jobs that are there to be found with the aid of an improved welfare office. But lets not think that this is going to be painless and lets also recall that these reforms worked for Germany in large part by making the domestic economy worker cheaper and more insecure while the economy as a whole powered ahead under an export engine. We need to be very cautious about replicating this in an environment where our exports are….fuzzy.