What do Trinity Business School researchers do? Come along on Friday and see. For FREE!

Tag Archives: History

Disruptive Innovation and Irish Universities post-Leporte

History and business are rarely taught or even studied together. That’s a pity. Economic history, as subject, has disappeared down the memory hole. What is more worrying perhaps is that the methods of historical analysis, careful source text reinterpretations, critical data analysis and a cool analysis, are not often applied to business. Enter Jill Lepore, a Harvard historian, to remind us why this ahistorical business analysis is a weak approach Continue reading

History and business are rarely taught or even studied together. That’s a pity. Economic history, as subject, has disappeared down the memory hole. What is more worrying perhaps is that the methods of historical analysis, careful source text reinterpretations, critical data analysis and a cool analysis, are not often applied to business. Enter Jill Lepore, a Harvard historian, to remind us why this ahistorical business analysis is a weak approach Continue reading

Further thoughts on TCD rebranding

The TCD re branding issue rolls on. There is a meeting planned for Friday, an open forum style. It will be interesting to hear what developments have happened. Since my last post some further thoughts have come to me. So is it out with the old and in with the new?

There is an argument advanced that we need to change our name, as shown to the world. People, it seems, cannot understand that we as a college are a university. Somehow the lack of ‘university’ in our name is a bar to students. I think that this fails at the first hurdle. One doesn’t have to like the rankings race to use it. The THES world university rankings for 2014 are instructive. In the top 100 we see: California Institute of Technology, Massachusetts Institute of Technology, Imperial College London, Swiss Federal Institute of Technology, University College London, Georgia Institute of Technology, London School of Economics, Karolinska Institute, Ecole Polytechnique Federal de Lausanne, Korea Advanced Institute of Science and Technology, Ecole Normal Superieure. 20% of the top 50 are in the same non-university-name boat as TCD. I seriously doubt that they are concerned at the lack of the word “university” in their name. I doubt that they are concerned that people will look at LSE’s name and go “hmm…. Is that a world-class third level institution or a school?” The implication is that students in China, for that is where the argument lies we are told, cannot distinguish. We would want to wonder if we want these anyhow. Much high-end chinese consumption is of what might be called Veblen goods, or snob goods, conspicuous consumption designed to show that one can. Leading university ‘brands’ can fall into this category.

A further argument is that while the students don’t get confused their employers will, not knowing that Trinity College Dublin is a university. From talking to people on the front-line of exports the greater problem in China is that many are unaware of where and what Ireland is. That’s not something TCD can change. The old US saw was “how will it play in Peoria”. We now need to be concerned it seems as to “how will it play in Puyang”. This presupposes of course that we want it to play there. Chinese students play an important role in Irish universities, at all levels. I have had and have now exceptionally good Chinese students in the MSc and PhD, ad know others have also. However, as a group overall they make up a vanishingly small percentage of students. The latest HEA figures give the full-time equivalent as follows : DCU 0.58%, NUIG 0.43%, NUIM 0.79%, TCD 0.64%, UCC 1.56%, UCD 1.84%, UL 1.00%. We can perhaps apply a x2 correction factor to the level to the numbers to get to fee impact but then we need to rebate that by the % of university income that comes from fees and fee waiver. Lets say that perhaps between 1-2% of university income may come from Chinese students. That’s a small tail to be wagging a large dog. To stake a strategy that affects all now and in the future on a small group which even if it were to show massive growth would still only amount to a small group would seem to be putting the cart before the horse.

In any case, the chasing the Chinese game is one that all universities are playing. We might be better off looking to expand in other areas such as Latin America, Sub-Saharan Africa, or MENA. An OECD 2010 study looked at the emergent global middle class, and these areas, while smaller than East Asia, are expected to show high levels of growth. Lets ask “how will it play in Pretoria” or “how will it play in Porto Alegre”. Lets try to entice more students from areas that are closer culturally and geographically and lets not get lost in the herd of the 1000’s of other universities chasing the chinese market.

College is, for good or ill, both ancient and modern. We are unique in Ireland and amongst the few in the world in the span of time over which we have operated. We should celebrate this in how we project ourselves to the world. The new logo does nothing to indicate that we are a member of the Coimbra group; it does nothing to indicate that we are a Tudor foundation; it is at best bland and at worst looks like a dodgy app downloaded from an off-piste store. Manchester in their rebranding cunningly incorporated their founding date. Where in the new logo does it suggest that TCD is 400+years old? Nowhere. Compare the two logos…

versus

We lose small but important elements of history in the focus group formed blandness that is the proposal. For instance, we have removed the portcullis from the castle. Compare the two below

This may seem small but the portcullis was the badge of Margaret Beaufort, mother of Henry VII, founder of the Tudor dynasty whose last member Elizabeth I was the founder of the college. It seems reasonable to me that the founder’s arms might be retained in part. Doing so is not to in any way approve or disapprove of their politico-historical activities. It is to recognize that we are a Tudor foundation.

We have removed the clasped bible from the shield and replaced it with an open book, to show we are open. This issue seems not to worry Cambridge, whose coat of arms shows a similar closed book. If we are to have an open book then we should endeavour to have 1592 inscribed therein to remind people that we are an older university.There is also a perception that the objective is to secularise the shield. Leaving aside the incongruity of a college named after a particular deity trying to secularise part of its identity, a glance at the coats of arms and public logotypes of ancient universities shows a plethora of religious motifs. I warrant that in Heidelberg, or Salamanca or Coimbra they are not concerned about the overt particular religious symbolism on their logos. Nor should we be. We should instead use this as an example of how we can evolve from an explicitly religious foundation to a modern open university.

We have removed the clasped bible from the shield and replaced it with an open book, to show we are open. This issue seems not to worry Cambridge, whose coat of arms shows a similar closed book. If we are to have an open book then we should endeavour to have 1592 inscribed therein to remind people that we are an older university.There is also a perception that the objective is to secularise the shield. Leaving aside the incongruity of a college named after a particular deity trying to secularise part of its identity, a glance at the coats of arms and public logotypes of ancient universities shows a plethora of religious motifs. I warrant that in Heidelberg, or Salamanca or Coimbra they are not concerned about the overt particular religious symbolism on their logos. Nor should we be. We should instead use this as an example of how we can evolve from an explicitly religious foundation to a modern open university.

On the towers of the castle of the previous shield we saw two red flags – these are now gone replaced by blocky dark icons. The previous standards were the cross of St George and St Patrick’s saltire. Again, for no good reason historical significance has been lost. The meaning of the two flags together was to represent unity. We should use this as showing that we have as a college been a bridge for the many traditions of this state throughout centuries. Instead it is down the memory hole with it….

We have changed the colours from blue and gold to blue and white. There is a frankly risible argument that blue and gold is confusable with the blue and yellow of brands such as Ryanair, Ikea Walmart etc.. It is seen, we are told, as cheap. Leaving aside some of their more unpleasant practices, if TCD were to be confusable in its space with the world leaders of Walmart, Ryanair and Visa we would be in a much better place than we are now. Blue and white is to be used. Will we now be confused with Sherry Fitzgerald, Boots, Cadburys, Danone or Sprite or Axa? In parenthesis, the blue and white colour palate is heavily used in the corporate world. A look at the Interbrand top 100 will show this clearly. Some persons might well see moving us towards this palate as a subliminal move to a more corporate look.

We have changed the colours from blue and gold to blue and white. There is a frankly risible argument that blue and gold is confusable with the blue and yellow of brands such as Ryanair, Ikea Walmart etc.. It is seen, we are told, as cheap. Leaving aside some of their more unpleasant practices, if TCD were to be confusable in its space with the world leaders of Walmart, Ryanair and Visa we would be in a much better place than we are now. Blue and white is to be used. Will we now be confused with Sherry Fitzgerald, Boots, Cadburys, Danone or Sprite or Axa? In parenthesis, the blue and white colour palate is heavily used in the corporate world. A look at the Interbrand top 100 will show this clearly. Some persons might well see moving us towards this palate as a subliminal move to a more corporate look.

The colours as per the previous crest also have historical significance. The crest of the Tudor Kingdom of Ireland (recall we are a Tudor foundation) was a golden harp on an blue background, an evolution of earlier normal influenced Irish crests and badges. That is why we have the colours of the original shield, and this palette is retained (without any concerns around confusion with value brands) in the presidential (previously royal) standard of Ireland . The new harp also eliminates the shamrock that was in profile on the previous one, again seemingly without any rationale.

The colours as per the previous crest also have historical significance. The crest of the Tudor Kingdom of Ireland (recall we are a Tudor foundation) was a golden harp on an blue background, an evolution of earlier normal influenced Irish crests and badges. That is why we have the colours of the original shield, and this palette is retained (without any concerns around confusion with value brands) in the presidential (previously royal) standard of Ireland . The new harp also eliminates the shamrock that was in profile on the previous one, again seemingly without any rationale.

A final argument used by some, not thankfully in TCD, is that for a rebrand €100k is not much. It may not be for some but for a cash starved deficit running univeristy its a good chunk of money. As paper never refused ink no consultant ever refused commission. Spending this money, tampering with a brand that has stood the test of time in the hope that it might attract some more Chinese students, that seems wrongheaded. It does nothing to advance teaching and learning excellence, nothing to advance research excellence, adds nothing to the student experience. In that context, its a waste of money.

Famine Memories

We think of the Great Irish Famine as “ago” as in long long ago. And it was, of course. The Famine took place between 1845-1848 and had a shattering, transformative effect on Irish society and economic life.

And yet… yesterday I had lunch with a retired colleague, a man in his later sixties. His grandfather was born in 1839, and thus lived through this. His father recounted stories to him passed from his father in turn, of the micro tragedies in the area – what familes lived and died where, who lived and how. Its as close to a living witness to this event as we can get.

Ireland – A nation of economic Bourbons?

This is an edited and extended version of a column in the Irish Examiner 30 November 2013.

Tallyrand, the great French statesman and survivor, declared on its restoration that the House of Bourbon “had forgotten nothing and learned nothing” . He referred to the reflexive actions of the new King towards autocracy and revenge. In many ways, the Irish are economic bourbons – we remember nothing and we forget nothing. We don’t learn from history in Ireland. Part of the problem is that we perhaps have too much history. There is always an exception, some time that if not different was not quite the same to allow us the out of saying “ah, but this time its different”. From there it’s a short drive turning a corner, carefully not driving over the green shoots to see sound fundamentals and away we go.

Tallyrand, the great French statesman and survivor, declared on its restoration that the House of Bourbon “had forgotten nothing and learned nothing” . He referred to the reflexive actions of the new King towards autocracy and revenge. In many ways, the Irish are economic bourbons – we remember nothing and we forget nothing. We don’t learn from history in Ireland. Part of the problem is that we perhaps have too much history. There is always an exception, some time that if not different was not quite the same to allow us the out of saying “ah, but this time its different”. From there it’s a short drive turning a corner, carefully not driving over the green shoots to see sound fundamentals and away we go.

The great economic historian Cormac O’Grada noted in 2011 that this crisis was the fifth major episode of emigration in the history of the state. If we add in the Civil War, that’s one every 14 years, or 1.5 per generation. This is probably a world record for crises. Lets look at these and see what we can learn. In the 1930s we had a crisis when DeValera, in what I can only think of as an act of economic lunacy declared an economic war with the UK, our then vastly predominate trading partner. Leaving aside the rights and wrongs, the economic war only ended when it became an irritant to the UK in their need to focus on the immanent existential threat of Nazi Germany. Throughout the Second World War the small, import substituting industrial companies encouraged by Dev as part of his drive towards autarky, a sort of 1930s North Korea with priests, were hammered badly. By comparison other neutrals enjoyed commodity booms. We managed to lag the other neutrals by a considerable margin before, during and after the war, in terms of growth. We exported people and cattle, usually in the same boats. The 1950s, dominated by DeValera again, were a grim decade, with declining population and falling living standards. It took decades of hard work to turn the country to a paying proposition and then in the 1970s the weak government of Garret Fitzgerald followed by the Trimalchian banquet of Haughey increased the national debt tenfold in the 1972-82 period. In some ways Haugheys ‘L’etat, cest Moi’ approach to money echoed the mysterious conversion of bonds raised overseas in the 1916-21 period for the state into shares held by Eamonn DeValera in his own private newspaper. In the 1970s and 80s in particular of course we also renewed our love affair with exporting live cattle to Libya and people to anywhere which would take them legally or no. The hard work of the 1990s was of course blown to pieces by the collective folly of the credit boom followed by the Masque of the Red Death that was the fumbled bumble of the Cowan governments decline into national bankruptcy.

The great economic historian Cormac O’Grada noted in 2011 that this crisis was the fifth major episode of emigration in the history of the state. If we add in the Civil War, that’s one every 14 years, or 1.5 per generation. This is probably a world record for crises. Lets look at these and see what we can learn. In the 1930s we had a crisis when DeValera, in what I can only think of as an act of economic lunacy declared an economic war with the UK, our then vastly predominate trading partner. Leaving aside the rights and wrongs, the economic war only ended when it became an irritant to the UK in their need to focus on the immanent existential threat of Nazi Germany. Throughout the Second World War the small, import substituting industrial companies encouraged by Dev as part of his drive towards autarky, a sort of 1930s North Korea with priests, were hammered badly. By comparison other neutrals enjoyed commodity booms. We managed to lag the other neutrals by a considerable margin before, during and after the war, in terms of growth. We exported people and cattle, usually in the same boats. The 1950s, dominated by DeValera again, were a grim decade, with declining population and falling living standards. It took decades of hard work to turn the country to a paying proposition and then in the 1970s the weak government of Garret Fitzgerald followed by the Trimalchian banquet of Haughey increased the national debt tenfold in the 1972-82 period. In some ways Haugheys ‘L’etat, cest Moi’ approach to money echoed the mysterious conversion of bonds raised overseas in the 1916-21 period for the state into shares held by Eamonn DeValera in his own private newspaper. In the 1970s and 80s in particular of course we also renewed our love affair with exporting live cattle to Libya and people to anywhere which would take them legally or no. The hard work of the 1990s was of course blown to pieces by the collective folly of the credit boom followed by the Masque of the Red Death that was the fumbled bumble of the Cowan governments decline into national bankruptcy.

Theres a broad thread running through this. It is Fianna Fail. This is not to say that FF are historys most evil monsters. They are not, they are a party that is as perfectly evolved to populist democracy as a great white shark is to devouring anything it can. Democratic to its very core, they time and again hold up a mirror to the Irish electorate ,and get elected. Usually this ends badly, as the nature of democracy is for people to vote for jam today and tomorrow. It is only when the chips are really down that we as a people turn to the unpalatable alternative, usually wrapped in a light blue wrapper. As Pogo stated – we have met the enemy and he is us.

We learn nothing. We now see the undeniable starting point of a new, perhaps localized, but undoubted bubble in the housing market. On admittedly low volume we see house prices rising by double digit figures. This is not greeted with horror as it should be. Instead it is seen and hailed as a success. Five years from the bursting of the bubble, the consequences of which took us from a national debt to GDP ratio of 25% to the present dizzying heights of near to 125%, which has resulted in the return of our favourite export Canned Paddy (now in new exciting flavors such as WellEducated Paddy to complement the old favorite Labourer Paddy), we have simply forgotten that rising house prices are not a good thing.

We learn nothing. We now see the undeniable starting point of a new, perhaps localized, but undoubted bubble in the housing market. On admittedly low volume we see house prices rising by double digit figures. This is not greeted with horror as it should be. Instead it is seen and hailed as a success. Five years from the bursting of the bubble, the consequences of which took us from a national debt to GDP ratio of 25% to the present dizzying heights of near to 125%, which has resulted in the return of our favourite export Canned Paddy (now in new exciting flavors such as WellEducated Paddy to complement the old favorite Labourer Paddy), we have simply forgotten that rising house prices are not a good thing.

National Economic Bourbonism exists not just in house prices. There will be a delicious, and literally dark, irony if the day after we exit the bailout a national electricity strike takes hold. We can bluster about cloud computing, waffle about Silicon Docks and plamas about high tech exports till snowmen dance on the plains of Dis but if we cannot guarantee reliable electricity we are and deserve to be seen as not a fully modern society.

National Economic Bourbonism exists not just in house prices. There will be a delicious, and literally dark, irony if the day after we exit the bailout a national electricity strike takes hold. We can bluster about cloud computing, waffle about Silicon Docks and plamas about high tech exports till snowmen dance on the plains of Dis but if we cannot guarantee reliable electricity we are and deserve to be seen as not a fully modern society.

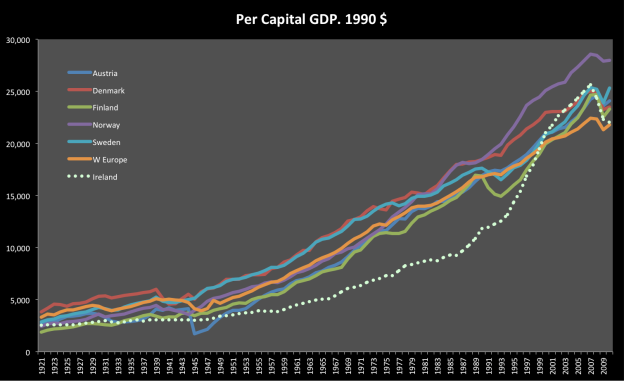

The exit of the Troika should be seen as an opportunity to become better than we have been. In 1921 the per capita national income of Ireland as a % of western European was 57%. In 1971 it stood at… 57%. Ireland had approximately the same per capita income in 1921 as Norway, Sweden and Austria and more than 50% more than finland. We have at least as much in terms of national resources as most of these. All are now considerably wealthier than us now and that is on GDP levels. Our GDP figures are puffed up by a MNC sector that is overly large and on which we are both overly dependent (its both totemic and a shibboleth) and yet unable to harness for tax or jobs. If we adjusted downwards the present day figures to GNP we would see the differences that much starker. We need to stop forgetting and take a long cold look at ourselves in the mirror. And we need to stop remembering and reminiscing and start wondering – what is it in the national culture that keeps us engaging in periodic bouts of economic self harm.

The Fiscal Compact and Ireland

I was asked to address the Oireachtas Subcommittee on European Affairs on the issue of the Fiscal Compact, and did so this morning (18 May 2012). Below is the briefing note which I forwarded to the members. We were asked to be succinct and to talk for 5 minutes prior to questioning, hence the rather stripped down nature of the material.

I have previously expressed my concerns on the fiscal compact in a number of fora, including my blog and my fortnightly column in the Irish Examiner. We are in effect being asked to incorporate into our constitution an econometric concept in order to become more Germanic. It is as Davy Stockbrokers put it in February “an abstract theoretical economic concept that cannot be observed with certainty.” We are therefore asked to support the immeasurable in pursuit of the unattainable. The only rational argument to support the compact is one of utter expediency : as we will require access to ESM funds from 2013 onward, whether we call it a ludicrous word such as “bailout” or a mere technical extension of the present “bailout”, and as such funds are as of now contingent on the fiscal compact, we need to think long and hard before rejecting it.In the context of the committee today, I have a number of points.

- Ireland as a state is broke. This is not an ideological but an arithmetic matter. We are forecast to have a net exchequer balance of -€21b in 2012, which is in the largest part made up of current expenditure running at €51b while current revenue reaches only €38b. Thus any proposal that can hold out a prospect of reducing this towards zero, especially on the current side, is to be carefully examined. That is not to say that I welcome the Fiscal Compact unreservedly- I do not. It has many issues which I would like to see modified, changed, dropped or better phrased. As the focus here is on the effect of the treaty were it to be adopted let me concentrate on that.

- Trajectory of debt. The fiscal compact states a maximum permissible deficit of 0.5% of GDP. It is easy to work out that with modest growth of nominal GDP the deficit rule will result in a long-term debt to GDP ratio of extremely low levels. The stable steady state debt/gdp ratio converges to d/g, where d is the average nominal deficit as a % GDP and g is the average nominal GDP growth. Since 1980 the average deficit has been 4.1% with average GDP growth at 8.2%. The figures since 2000 are 2.8% and 4.8%. We will if we wish to achieve the 60% debt to GDP figures have to achieve a nominal growth rate of at least 2% while keeping deficits at 1% or less. We are forecast to have a structural deficit of 5.5% in 2012. To move to a 0.5% deficit therefore is a massive multibillion-euro demand shock. To move from the forecast 2015 115% debt/GDP ratio to the 60% permissible is to remove some 90b in debt from the stock of Irish government debt, or the equivalent of the entire national debt as of 2010. To do this will require that we run structural surpluses (or find somehow that austerity does in fact lead to growth in nominal GDP). Demand effects aside, one has to wonder if this is within the capacity of the state to achieve such a massive transformation?

- An area of the treaty that has received scant analysis, surprisingly so, is the effect which it will have on bond markets and Europe.As noted we can amend the ratio of government debt to national income by decreasing debt and/or by increasing wealth. The focus of the compact is on the former. Europe as a whole is significantly over the 60% limit. As of 2011 eurostat figures the majority of individual countries are also over. Thus the adoption of the compact suggests a prolonged massive de leveraging of the European sovereign bond market. The euro 17 countries as a whole need to reduce debt/GDP ratios from 85% to 60%. At present terms that is a reduction of some 2.3 trillion euro. That is a massive fiscal drag to pose on Europe and compact is that if it succeeds it will gravely damage the sovereign bond market. Even well run countries such as Netherlands ( 2012 debt/GDP forecast 65%, 2012 GDP growth 1%, Unemployment 4.5%) and Austria ( 2012 forecasts Debt/GDP 73%, , Unemployment 4%, GDP growth 1%) will be required to retrench. This is not a recipe for growth in Europe, and given that exports are forecast to be the entire contribution to any GDP growth we may see will see the stifling of demand in one of our major markets. This point has been reiterated in the Financial Times which stated on Tuesday 17th in its editorial “A fiscal compact worth its name would have matched belt-tightening in deficit countries with expansion in surplus countries. Universal austerity will instead erode the gains from fiscal discipline by stunting the economic output from which public and private debt can be serviced” It has also been critiqued by a wide variety of other market and academic economists (see this Reuters article for a synopsis of the argument) . Swabia housewives alone cannot reinvigorate Europe. Nouriel Roubin has stated “Without a much easier monetary policy and a less front-loaded mode of fiscal austerity, the euro will not weaken, external competitiveness will not be restored, and the recession will deepen. And, without resumption of growth – not years down the line, but in 2012 – the stock and flow imbalances will become even more unsustainable. More Eurozone countries will be forced to restructure their debts, and eventually some will decide to exit the monetary union.” Such policies are the direct opposite of what we now see, with strict money and frontloading of austerity. He further stated “The trouble is that the Eurozone has an austerity strategy but no growth strategy. And, without that, all it has is a recession strategy that makes austerity and reform self-defeating, because, if output continues to contract, deficit and debt ratios will continue to rise to unsustainable levels. Moreover, the social and political backlash eventually will become overwhelming. A large (but not overwhelming) stock and flow of relatively low risk assets are required to support pension and investment funds. A shrunken market will be less able to fulfill that role. The fiscal compact therefore requires that over time trillions of euro of assets are removed from consideration of investors. The consequence of this will be an intensified move to safe haven assets such as the (to be radically shrunken) German bund market, driving down further German interest rates. Investors will have to accept radically lower long-term returns. Alternative investment classes seen as safe havens such as gold, or denominated in currencies such as the Norwegian kroner or Swiss franc will also attract investors, with knock-on consequences. The effect on Europe of a perpetual low cost of capital in the core and higher costs in the periphery cannot but exacerbate the existing core-periphery problems. In addition, low nominal rates lead ro negative real rates, a form of “financial repression” . Faced with a growing pension timebomb the shrinking of the pool of safe assets seems not sensible. Mercers 2011 Asset allocation survey indicates that most pension funds including Irish desired to increase not decrease their absolute and relative investment in domestic government bonds. There are plans to market up to 2b in domestic bonds to pension funds for annuity purposes. How these will be squared with decreases in the asset pool is unclear

- The fiscal treaty contains not just a set of macroeconomic thresholds but also under the Alert Mechanism Report looks at a series of more detailed ‘warning signs’. (See below). The first of these came out in mid February and as one might expect these show Ireland (as well as Greece and Spain) as being problematic. The warning indicators are shown below (courtesy of a CitiBank report). In the February report Ireland was shown to be in breach of 6 of these ( also shown below). What is interesting in the recent Citibank report (see http://ftalphaville.ft.com/blog/2012/04/16/962221/return-of-the-stability-and-growth-pact/ ) is that while the Irish economy in the boom years would have shown relatively good adherence to the headline fiscal treaty requirements, there is some evidence that the indicators below would have triggered concern. Ireland began to exhibit significant numbers of breaches in 2004 onwards, mainly due to house prices, private sector debt, labor costs and real effective exchange rates. However, these were all a consequence of the credit boom. While a procedure now is available to fine countries that, having been found to be severely imbalance do not take steps to adjust towards balance, this fine is only up to 0.1% GDP . We are all now painfully aware of the political reaction that was evident (and voted for enthusiastically) when people were ‘cribbing and moaning’ as one Taoiseach so memorably put it. One can easily imagine the same Taoiseach cheerfully explaining how a fine of ‘eh, a few hunnered million’ was a small price to pay for the continuation of our unique way of achieving economic success. In other words, the flaw in the fiscal treaty is that it concentrates on trying to achieve political economy aims by exclusively economic means. Is there now and will there be in future the political will in Ireland to face down domestic calls for the ignoring of warnings?

- There are a host of other issues with the compact that bear on domestic competency. First, we will need to ensure that we have domestic capacity to estimate independent credible (from a technical sense) structural budget estimates, in an economic environment where there are no set rules on how this is to be done. To do otherwise will be to force us to rely entirely on the commission. This will be a net additional resource requirement for universities, the fiscal council, ESRI or a new body. Below we see (courtesy of Davys http://www.davy.ie/content/pubarticles/fiscalcompact20120227.pdf and Dr Constantin Gurdgiv http://trueeconomics.blogspot.com/2012/03/2532012-irish-gdp-and-structural.html) how IMF and EU commission estimates of the structural deficit can differ wildly, and in the context of a strict limit this mattera. Is there willingness and resource to spend on this? Second, and following on from this, is there sufficient technical knowledge in both economic and negotiation skills in the government to argue the case where as is inevitable there will be divergence between the commission and the domestic estimates? Third, there is no mechanism that I can see whereby on re-estimation of the models countries that were previously deemed in deficit are now deemed in surplus (or vice versa) are ‘reimbursed’ for the mis-estimation de jure, and again will there be sufficient skill sets for such an argument? The experience of Ireland with regard to the promissory note saga suggests to me that we have demonstrated neither the technical nor the negotiation skills that would be required under either of the last two questions. Fourth, the present fiscal compact is one leg of a stool, and as such while it can work it will be a precarious balancing act. The interaction of government with society in the economic space consists of fiscal and monetary policy. We do not have government control at a European level over monetary policy, and again one can see the way in which this leads to direct countervailing of purposes where increased austerity over and above the domestic requirement is imposed in pursuit of a flawed monetary vision. This treaty will provide a (Germanic ordoliberal) common spending policy. What is missing is a common tax policy and a common policy on transfers. Is there domestic will or competence to open up the latter two as a European aim, with the certain knowledge that for compromise on one (transfers) compromise on the other (tax) will be demanded?

Macroeconomic Imbalance Indicators

Estimates of Structural Deficit

/

Down the Memory Hole: why we should give more priority to economic and financial history

A few months ago I found myself teaching third-year students for about one hour on the historical experience of stocks and bonds in relation to the risk/return characteristics. I’m sure most people who have taught finance will have come across these phenomena, where one finds oneself referring to a for the students historical but in ones own case very pertinent event, in my case the 1987 crash, and looking up realizing that this is so far beyond the life abd professional experience of the students that you may as well be talking about the reforms of the Roman bureaucracy by the Emperor Titus.

A few months ago I found myself teaching third-year students for about one hour on the historical experience of stocks and bonds in relation to the risk/return characteristics. I’m sure most people who have taught finance will have come across these phenomena, where one finds oneself referring to a for the students historical but in ones own case very pertinent event, in my case the 1987 crash, and looking up realizing that this is so far beyond the life abd professional experience of the students that you may as well be talking about the reforms of the Roman bureaucracy by the Emperor Titus.

We know that people generally speaking tend to engage in what financial economists call “hyperbolic discounting”, which applies both to the past as well as the future, resulting in a shorter term perception, giving greater weight, greater than would be appropriate given the distribution of outcomes, to more recent events. This also manifests itself in a number of other financial and behavioral biases. The bottom line is that there is always a tendency for people to consider that this time really is something new. And of course, this flies in the face of what we know from history. Probably the best book on economics and finance over last couple of years has been the book by Reinhard / Rogoff ” this time is different”, credit should know, it’s almost certainly not. In my view this book should be compulsory reading for anybody who thinks about being involved in financial and economic markets at any level. In my case the 1987 crash was memorable, of course as a major event in finance, and also because on that Monday I started work on the Central bank of Ireland.

We know that people generally speaking tend to engage in what financial economists call “hyperbolic discounting”, which applies both to the past as well as the future, resulting in a shorter term perception, giving greater weight, greater than would be appropriate given the distribution of outcomes, to more recent events. This also manifests itself in a number of other financial and behavioral biases. The bottom line is that there is always a tendency for people to consider that this time really is something new. And of course, this flies in the face of what we know from history. Probably the best book on economics and finance over last couple of years has been the book by Reinhard / Rogoff ” this time is different”, credit should know, it’s almost certainly not. In my view this book should be compulsory reading for anybody who thinks about being involved in financial and economic markets at any level. In my case the 1987 crash was memorable, of course as a major event in finance, and also because on that Monday I started work on the Central bank of Ireland.

This memory, and the realization that for many students, and don’t forget them in a couple of years these students will be the ones that will be managing your money, and knowledge of financial, business, or even economic history, is lacking. Earlier this year a study was undertaken by the St Paul’s Institute, which looked at the economic and financial historical knowledge of London finance professionals. The full study, available here, is a fascinating read about the attitudes of finance professionals in the city of London around the areas of ethics and integrity. What was reported widely, see for example an interesting report here, was a city professionals exhibited a profound lack of knowledge around the economic and financial history of the own profession. Quoting from the London Independent

This memory, and the realization that for many students, and don’t forget them in a couple of years these students will be the ones that will be managing your money, and knowledge of financial, business, or even economic history, is lacking. Earlier this year a study was undertaken by the St Paul’s Institute, which looked at the economic and financial historical knowledge of London finance professionals. The full study, available here, is a fascinating read about the attitudes of finance professionals in the city of London around the areas of ethics and integrity. What was reported widely, see for example an interesting report here, was a city professionals exhibited a profound lack of knowledge around the economic and financial history of the own profession. Quoting from the London Independent

In an indication that memories fade fast within the banking sector, less than a third of employees were able to pin point 1980 and 1991/92 as the last two dates major recessions took place in the UK. In contrast, more than three-quarters of respondents correctly answered that the post-credit crunch recession began in 2008.

Equally, almost seven in 10 people had no idea that this year is the 25th anniversary of the “Big Bang”, the major deregulation of Britain’s banking industry that allowed London to become the financial capital of the world – and an inevitable epicentre of the ongoing economic turmoil.

To me this is profoundly worrying. The words of George Orwell are very apt: he who controls the past controls the future. And it’s not just me that worried…the CFA Institute, the professional body that certifies and regulates the “front office” portfolio and institutional managers, is reported today in in the financial Times as also being concerned. The report is behind the financial Times registration barrier, registration is free, and provides limited access to a number of articles per month. Nonetheless, some quotes from it are illustrative.

CFA UK, which represents 9,000 investment professionals, argues that the study of financial history should form a major part of all compulsory education for retail and wholesale investment professionals. “Financial amnesia disarms individuals, the market and the regulator,” the body said. “It causes risk to be mispriced, bubbles to develop and crises to break.”

The education requirements for investment professionals in the UK do not oblige them to have “any understanding of financial history”, added Will Goodhart, chief executive of CFA UK. While the UK’s Financial Services Authority sets the framework for the Investment Management Certificate, the country’s most widely recognised qualification for investment professionals, CFA UK sets the questions. Mr Goodhart suggested that about 15 per cent of the syllabus focus on financial history.

The British CFA programme should be reformed to include “a practical history of financial markets, designed to remind us about the effects of liquidity, psychology and regulatory failure”, the report said.

It also advised the boards of financial institutions to undertake an annual “amnesia check”. “It would be reassuring to know that once a year the board of a financial services firm had reminded itself that this time it is not different,” Mr Goodhart said. The

The CFA Institute have a relationship with the number, about 100, universities where they provide input into Masters level degrees in finance The idea here is that the Masters in finance cover much of the ground of the professional qualifications of the CFA Institute, although no exemptions are given, and that they therefore provide both an academically rigorous as well as industry focused experience for students. Trinity College Dublin and University College Dublin are the only two such universities in Ireland which have courses so aligned. The MSc in finance in Trinity College, and the MBS in finance in UCD are the relevant courses. It’s instructive to note that examining the syllabi for these courses there appears to be no opportunity for students to study financial history. I should note that the initial design of the MSc in finance and Trinity College was mine, and therefore I should take some responsibility for not having included as an optional module, ab initio, a module on financial and economic history. In my defense I can note that there was a proposal the following year have such a module, but it was not felt that there would be sufficient numbers of students interested to warrant offering the course. And, the sad fact is, that this is probably the case. Students who have never been exposed to history are not likely to have an inherent appreciation of the importance of history.

What about other courses? I am the external examiner for the Masters in financial economics at University College Cork, and it is an excellent course of course, but it does not have a module on financial history. The University of Limerick offer a wonderful degree at Masters level in computational finance, the Masters In finance and capital markets in Dublin city University has been on the go for a number of decades and again provides excellent training, and there is a recently developed masters in financial engineering at NUIM. None of these, insofar as I can see from examining the course lists online, offer students a module in financial history.

it doesn’t seem to be any better in economics. The TCD masters in economics does not appear to have a module available on financial or economic history; nor does the largest masters in economics degree course, that run by UCD. This also seems to be the case in NUIM, and in Cork.

What about MBA degrees? If our financial and economic professionals were not been trained in a manner, which incorporates as a formal module and understanding of history perhaps, business masters of the universe are so being taught? Again from my knowledge there is no such module on the MBA Trinity , nor on the MBA offered in UCD, despite it being the only MBA in Ireland which is “triple accredited” and the only MBA in Ireland ranked in the Financial Times rankings. In fact the only mention of history on the UCD MBA site appears to be in the promotional brochure outlining the history of Dublin.

I haven’t looked at the situation in UK, USA. That would be an interesting master’s thesis, for a student to examine attitudes and approaches to the incorporation of financial and economic history into graduate professional training programs. But I am pretty certain that situation which I have described here in Ireland is representative of the vast majority of courses. The teaching of economic and financial history has never been a core strength, particularly in Ireland, of business schools. Even within economics departments economic history, still less the history of economic thought, has tended to be a very minority sport. Ireland in recent years has been blessed in having exceptionally talented economic historians, such as Kevin O’Rourke in TCD, and Morgan Kelly and Cormac O’Grada in UCD . Kevin has now left Trinity College, has taken a professorship at All Souls College Oxford; Cormac has retired; Morgan showed in his analysis of the economic crisis the benefits which a good grounding in historical concepts can provide.

The reality is that as people move and retire they are unlikely to be replaced, certainly not the same levels, and given that it takes decades of dedicated skill to achieve the levels of knowledge then certainly not at the same level, ab initio, in terms of intellectual firepower. Yet, who can doubt that a greater knowledge of history would be useful? Who can doubt that were people, particularly those entrusted with our financial and economic well-being, more aware of the cycles of the economy and of the markets, that they would be at least better armed in relation to realizing that this time is not different, and that by observing and learning from the past we can at least not be excused the knowledge that “we never knew this could happen”. Of course, there are no smart green nano bots, no patents, and very few high-tech spin-offs that come from providing economic and financial history courses. And therefore, given the dreadful trudge towards turning universities into some form of annex to an ill-defined “Smart economy” we will continue to churn out highly technically skilled economic and financial graduates whose only exposure to economic and financial history has come about through individual course leaders dropping nuggets of information into their courses, or for the select few more so motivated, from their own autodidactic endeavors. And that is one way to ensure that we have a dumb economy and one that is doomed to prove Santayana right : Those who cannot remember the past are condemned to repeat it.

The reality is that as people move and retire they are unlikely to be replaced, certainly not the same levels, and given that it takes decades of dedicated skill to achieve the levels of knowledge then certainly not at the same level, ab initio, in terms of intellectual firepower. Yet, who can doubt that a greater knowledge of history would be useful? Who can doubt that were people, particularly those entrusted with our financial and economic well-being, more aware of the cycles of the economy and of the markets, that they would be at least better armed in relation to realizing that this time is not different, and that by observing and learning from the past we can at least not be excused the knowledge that “we never knew this could happen”. Of course, there are no smart green nano bots, no patents, and very few high-tech spin-offs that come from providing economic and financial history courses. And therefore, given the dreadful trudge towards turning universities into some form of annex to an ill-defined “Smart economy” we will continue to churn out highly technically skilled economic and financial graduates whose only exposure to economic and financial history has come about through individual course leaders dropping nuggets of information into their courses, or for the select few more so motivated, from their own autodidactic endeavors. And that is one way to ensure that we have a dumb economy and one that is doomed to prove Santayana right : Those who cannot remember the past are condemned to repeat it.