I have written a number of times about the usefulness of the Phillips GSADF test for bubble detection. It has been used extensivly for bubble detection. google “gsadf bubble” if you dont believe me. So… Continue reading

Monthly Archives: September 2014

Irish Water – A Damp Omnishambles

No-Carbon energy generation worldwide by country

The Financial Times – Getting it wrong on Ireland, and how

So, the FT has an oped on the Irish recovery. And it is, sadly, about as wrong as can be. Continue reading

Pledges on political power to the northern lands….a good idea?

An independent Scotland faces a banking crisis…what does HM Treasury do?

One of the arguments around the Scottish referendum on independence is centred on its banks. These are, simply, ginormous at around 1200% GDP. There is no way that an independent Scotland could, if push came to shove, bail them out. QED, don’t take the risk. Stick with the Treasury and the UK…

One of the arguments around the Scottish referendum on independence is centred on its banks. These are, simply, ginormous at around 1200% GDP. There is no way that an independent Scotland could, if push came to shove, bail them out. QED, don’t take the risk. Stick with the Treasury and the UK…

Hmm. Not quite as simple as it seems when you look at Ireland.

The Irish banking collapse of 2008 saw us borrow money hither and yon, from the IMF, the EU, and …the UK. The UK lent us money to defray this, as did the Danes and the Swedes. Why? Bilateral trade. These nations trade a lot with us and we with them. And its not good for your exports if the trading partner is utterly bankrupt, so best to lend a hand. A soft hand.

Ireland accounts for about €27b of uk exports, Scotland for about three times that from the rest of the UK. So, and independent Scotland would be a large and important trading partner with the rUK, and not one whom the Treasury would wish to see go under. Hence, were push to come to shove, despite all the warnings and threats, it would be in the best interest of the rUK to extend soft loans to Scottish banks and the government in the event of a rerun of 2008. Nothing political, just business.

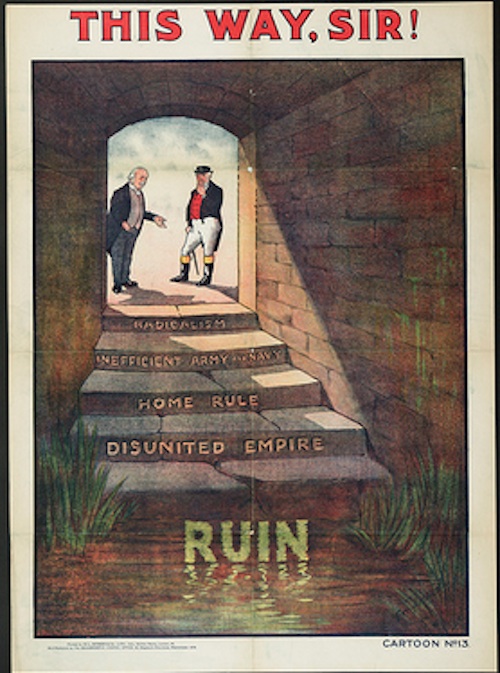

Images from the last time these Islands looked at “home rule”…any resonances?

What Ireland’s crash tells us about bankers views on Scottish Independence

The next week is going to be fascinating. I have no idea how Scotland will vote, for or against independence. I have no idea how I would vote were I there. Economically, there is probably a somewhat stronger argument for NO than YES, if you believe the politicians promises. But national self determination is not about economics alone. Ireland has seen a massive crash, from its overblown banking system. How bankers and other vested interests responded to that is very instructive for the scottish debate

How to mitigate the next recession..

The madness, it seems, has returned. Perhaps like those insects that lay eggs that can survive drought and then swarm back, it never left, just lay dormant. Santayana’s maxim of the inevitability of repetition if one comes from a position of ignorance could be the warcry of Irish policy “ we repeat our mistakes, and we’re proud of it. Vote us” And we do. Continue reading