This is a extended version of a column published in The Irish Examiner 9 February 2013

So now we know – its Frankfurts way, all the way. One can only wonder what was going through the minds of the labour party ministers as they signed off the deal that irrevocably linked the Anglo debt to the state. Was it the words of Collins on his signing the AngloIrish treaty , in a political sense? Or was it the words of Mr Rabbitt on the distinction between electioneering and governing? Or was it simply thanks that there was a deal, any deal, that didn’t require a payment on 31 March? Regardless it is now clear that they have swapped a shortterm loan of dubious legality and even more dubious morality for a longterm loan of impeccable national standing. There is zero chance of ever getting out of this now. Zero. All major parties have now voted for the linking of state and private debts. Labour which stood against the 2008 deal, mainly because it gave too much power to the minister and was rushed through has now rushed through a deal that gives sweeping power to the minister. The view within the tent must be so much better than without.

So now we know – its Frankfurts way, all the way. One can only wonder what was going through the minds of the labour party ministers as they signed off the deal that irrevocably linked the Anglo debt to the state. Was it the words of Collins on his signing the AngloIrish treaty , in a political sense? Or was it the words of Mr Rabbitt on the distinction between electioneering and governing? Or was it simply thanks that there was a deal, any deal, that didn’t require a payment on 31 March? Regardless it is now clear that they have swapped a shortterm loan of dubious legality and even more dubious morality for a longterm loan of impeccable national standing. There is zero chance of ever getting out of this now. Zero. All major parties have now voted for the linking of state and private debts. Labour which stood against the 2008 deal, mainly because it gave too much power to the minister and was rushed through has now rushed through a deal that gives sweeping power to the minister. The view within the tent must be so much better than without.

In any sense, we now have the full foul flower of the 2008 banking deal. Having sunk 30+ billion of cold hard cash into the wreck of the banks we have now sunk a further 30b of taxpayers cash into an arguably worse deal, paying for the folly of the guarantee to the anglo subordinated bondholders. This deal flies in the face of all the talk (or as Pat Rabbitt might call it “Auld Palaver” ) at the European level of delinking banking and sovereign debt. It cements and accelerates at the European level the move away from an integrated and globalized banking system and reinforces the trend towards national based banking systems. It makes a mockery of the moves towards banking union in that it demonstrates explicitly the fact that the national state remains on the hook. This national banking approach is evident in more than this. Despite a desire and despite the evident need for one the European leaders still cannot put in place a proper banking union template – national taxpayer cofinancing for bank failures will still be required. In the UK the moves to increased regulation include a move towards a sharper distinction between UK, other EEA and non EEA banks. We have seen a continual concern in the core about TARGET2 balances viz a viz peripheral countries, with the most convincing explanation suggesting that these flows demonstrate a pulling back to the core of credit previously extended to the periphery. All round there is a renationalization in the financial sphere and this deal is part of that.

While financial globalization has brought problems to us, the evidence is by and large that it brings benefits. Deeper, broader more responsive banking systems are associated with greater economic growth. There is an issue as to the lags, and there is an issue also about what we might call utility (the basic money transmission and simple savings/loans) versus industrial banking, but overall the evidence is favourable. In acquiescing to this ECB driven linkage of the banking debt to the sovereign the Irish government has acquiesced in this renationalization.

What of the deal itself? Like any deal it has good and bad points. I remain convinced that the economically and morally appropriate thing to have done was not to pay. However, we have now done so. The deal is complex. It in essence involves IBRC being liquidated, the central bank seizing the asset (promissory notes) that was used as collateral for it extending liquidity, and the government and the central bank agreeing to swap this worthless wretched note for proper NTMA bonds. These bonds are of a longer term and at no more cost than the promissory note so in terms of the present day value they are less. How much less is a matter of some conjecture as the terms of the newly issued bonds are floating. But a reasonable conjecture would be that the value is between about 40-60% of the total amount.

Before we start doing cartwheels of delight however several notes of caution must be struck.

First, there is a requirement in the deal that the central bank will not hold onto these bonds to maturity in total. They will have to sell some. This introduces a degree of uncertainty as to the deal.

Second, the cost is unclear, but we know that we are right now at a low point of the interest rate cycle. As the cost of the bonds fluctuates upwards as do interest rates the cost must rise as do interest rates. The bonds are pegged to a cost over 6m EURIBOR rates. Nobody can forecast with any certainty the rate of EURIBOR, that rate at which large banks lend to each other, over the next few months never mind the next few decades. At a low point in the interest rate cycle a truly favorable deal would have fixed the cost now. The average 6m EURIBOR rate over the last twenty years has been just over 4%. By comparison a rate set at the ECB Main Refinancing Rate would have been cheaper. This leaves aside also the issue that the cy calculation of the EURIBOR itself is under scrutiny and threat, with panel banks pulling out of its calculation right left and center.

Third, much is being made of the argument that, over time, inflation and GDP growth will erode the “real value” of the bonds. This is in one way merely a restatement of the fact that the present value is lower than the total nominal amount. But it also seems to ignore that the ECB have an inflation target (and it has shown itself to be a strong inflation fighter) of 2%. The value will take a long time to fall.

Fourth, even if we were to take the present value as being50% of the face value we have still, at a stroke, added one years deficit. This is hardly consistent with fiscal prudence.

Fifth, there is a worrying line of argument, from the Taoiseach down, that saving the billion a year in funding as we are, we can thus relax austerity measures by a concomitant amount. Even as we are looking at structural budget balances forecast to be over 5% in 2014 ( versus a surplus in Greece ) it is hardly time to raise expectations that this deal is agame changer. Rather than relax the adjustment process (which can only be for party gain) the adjustment should be continued and in effect accelerated with this additional fiscal benefit.

Sixth, the bill contains sweeping powers for the minister for finance. Enabling acts that allow ministers to override commercial judgement on bank asset purchases, create at their own judgement securities (whatever happened to the idea of the Dail having a say on money bills?), or override and instruct the liquidator do not seem to me to be good laws. When dealing with billions of public money the elected representatives should always have the final say.

Finally, we have been here before. In 2008 we saw the oireachtas rush to judgment with complex legislation in the mistaken belief that the issue was one of liquidity rather than solvncy. Then it was the banks, now we are doing the same with the state. Saving cash on an ongoing basis is a liquidity issue. The deal does nothing to adjust the solvency of the state. And that is what a deal should have done.

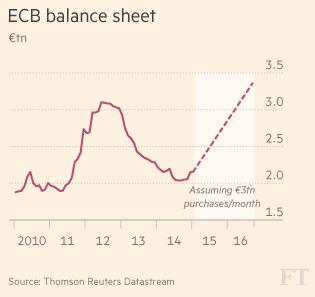

So the ECB has, years late and trillions short, decided to act rather than to react. Having passively allowed its balance sheet, shrink By €1 trillion over the last two years it has now decided to inflated its balance sheet by €1 trillion over the next two years. One of the things that central banks are supposed to do is to ensure stability. Looking back from the end of 2016 the gyrations of the ECB balance sheet will hardly inspire. Nonetheless the proposal to engage in quantitative easing, of a sort, is welcome. But its more a constipated squeezing than real quantitative easing.

So the ECB has, years late and trillions short, decided to act rather than to react. Having passively allowed its balance sheet, shrink By €1 trillion over the last two years it has now decided to inflated its balance sheet by €1 trillion over the next two years. One of the things that central banks are supposed to do is to ensure stability. Looking back from the end of 2016 the gyrations of the ECB balance sheet will hardly inspire. Nonetheless the proposal to engage in quantitative easing, of a sort, is welcome. But its more a constipated squeezing than real quantitative easing.